Crypto lol

Your lack of first principles is concerning.

As I watch the crypto winter freeze over, as programmers we all should learn an important lesson from this. See, I knew this was going to happen. I told everyone this would happen back in 2015, and whilst it took far longer than I thought it would eventually the Pied Piper played and all the kids were lost.

Lets begin.

Back in early 2015 I cofounded a Superannuation company as CTO. For my international audience (who am I kidding, this blog has 0 readers), Superannuation is kind of like a compulsory IRA scheme that every Australian is mandated to pay in to. It is a grossly destructive stealth tax and it massively distorts the Australian economy. The startup was created to allow people to extract their mandated wealth transfer outside of government approved schemes and into their own control.

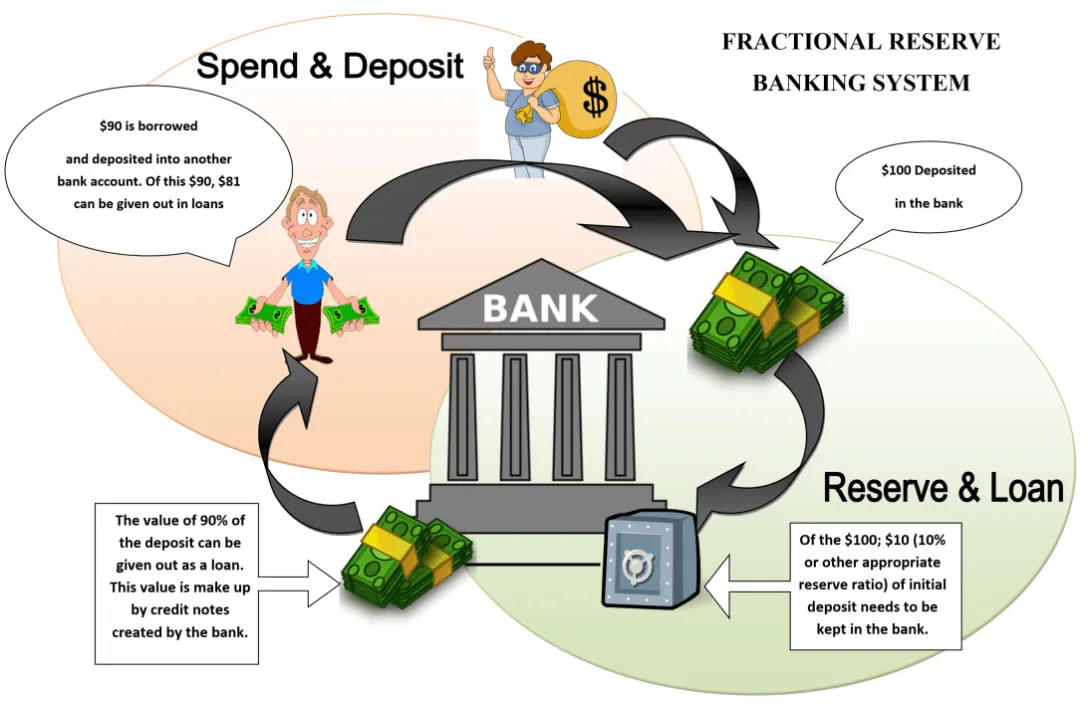

My personal drive with this startup grew from my absolute disgust with the banking system. I'd recently learned how it worked, and the giant corrupt ponzi scheme that it is. I was determined to be able to preserve my wealth by finding a way to control it, and I felt a deep civic duty to allow others to do the same.

Before I went down this route, the thought of doing anything in the financial system intimidated me to no end. I'd been burned by economics at university - the concepts had never made sense. I'd never had that feeling of intuition you get from actually understanding something. It seemed like an impossibly complex thing for someone as hopeless as me to tackle.

I was lucky that I randomly found a resource that changed my life. It opened up the world wide financial system to me by describing it from the very basic building blocks to many of the complex systems I'd seen before. It described the principles of the monetary system, and then made sure it was drilled into my relatively stupid brain, and then built upon that structural foundation via examples. Without understanding these foundations, there is no way I would have been able to start a financial services company like this. I'm trying to stress here that the principles are vitally important - they underpinned everything that happened after that, and without them I'd be lost. They were the foundation for the "house" that I built on them.

Our very first customer was a commercial blind installer that invested all of his retirement money in beachside properties in Uruguay. We thought it was crazy but this is before we understood the AirBnB model. These properties were booked fully for ~8 months of the year as various groups from (primarily) Israel and the US booked them to coincide with graduating, finishing military service etc. He was doing really well out of it when I left, OR it was a great way to launder money. We could never really tell, KYC be damned.

Our second customer was young, 32 maybe. At this time I was 26. He had maybe $35,000 in liquid assets in his Superannuation fund when he transfered to us. He joined us with the sole question being "could he invest in Bitcoin?". I said sure, the fund accountant said wut, and he did it. Back then the price per Bitcoin was about $260/Bitcoin AUD (memory is slippery and may be lying to me here), and he went all in. We all thought he was as crazy as the first guy, but 18 months later it was $19,000AUD per coin and the joke was on us. At the end of the day we stood by the company motto - invest your money how you want; the outcome is on you.

I believe we were the first fund of any sort in Australia to orchestrate these investments. We sure as hell were the only ones doing tax reporting on it. I might actually own all the software patents for this in Australia - they were put up for review but I dont know if they ever were granted. We were so far in front of everyone that we were asked by the Australian Tax Office to sit on the industry advisory panel a year or so later.

The point is I was close to the action. Closer than most. I watched bitcoin climb long before any of these eXpErTs had ever heard of it. There was obviously money to be made, and yet I stayed out of it. The current nuclear armageddon of crypto devaluation and the wipeouts of FTX, Celcius, and the impending doom of their colleagues in this space was blindingly clear to me from day one. I'm no genius nor tea leaf reader nor wizard of oz. All I did was understand the key principles of bitcoin and technology, and the answer was as clear as day.

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.” ― Sun Tzu, The Art of War

Money as a concept is defined by a set of principles. Theres 6 or 7 of them, and one of these principles is "scarcity" - money has to be uncommon enough to be valuable, but not so uncommon as to be impractically rare to use. This makes intuitive sense to people. Gold is rare, but not rare enough that its "super rare". Conversely it would be very hard to use the Mona Lisa as money because there is only one of them - it's "too rare" to be useful. Satoshi (the psuedononymous creator of bitcoin) understood this; this is why bitcoin is limited to 21,000,000 units. This volume limit makes it a great candidate for money - it's scarce enough to be valuable, common enough to useful, however...

The reason I never touched crypto is that the scarcity is artificial. Sure, there is a hard limit on the number of bitcoins, but there are unlimited possible versions of bitcoin. I have been telling people this for the better part of a decade, and we can see it now - you can create and issue a new <WHATEVER>-coin in a few moments on your laptop. The explosion of and collapse of, and the sheer amount of bullshit coins is testament to this reality. Bitcoin isn't special other than being the first. But even though bitcoin has an in inbuilt limit, this only applies to bitcoin. I can make jamie-coin tomorrow and give it a limit of 20,000,001. Or I can make something and call it bitcoin-v2 and give it a limit of 1 billion.

It is important to understand that blockchain, the thing that bitcoin lives on, is technology. I have a particular definition of technology, and much like money is founded upon a set of principles. One of these definitions is the output of technology reduces scarcity. Wherever technology flourishes, more stuff is available, be it material goods, the music you can hear, the time you can dedicate to learning to surf, the experiences you can have or the spiritual journey you can embark upon. Because of "this" technology that has been created there is now "more" in the universe. Reality is now richer, more vibrant, denser.

With bitcoin we have money (bitcoin) and we have technology (blockchain). Money is partially defined by scarcity. Technology is partially defined by removing scarcity. These two things can never coexist - they are diametrically opposed. Each one is antimatter to the other. Knowing only these facts is all that anyone needed to know why crypto would go bust, and the hucksters running around in it are nothing more than modern day used-car salesmen.

First principles told me this from day one. No rocket science. No mathematics. No heavenly divinations. No wisdom or instinct or gut feeling. Just fundementals. Fundementals are a powerful protective force. Learn the how and the why before you do. Don't be a crypto-weenie.

You may think that there is a difference between understanding a HashMap and the entire crypto market melting down. You're wrong. For everyone that made money in the market, many more lost money. These people thought that arbitrarily created bytes on distributed storage were a solution to a problem they didn't understand, using a model they didn't understand. They never understood the basics. The perpetually mediocre institutional investors have lost billions. These people never understood money. They then tried to replace something they didn't understand with something they also didn't understand. They ended up just trend chasing; and now most of these clowns are in the deepest hole possible. Despite all the hype, millions of people said "no, this doesn't make sense", or more powerfully "no, I don't understand this". By admitting their own ignorance they refused to be exposed to it, and thus have lost nothing.

As a programmer, we should take this as a lesson. Go and learn your data structures. Go and learn your industry domain. Don't just rely on perfect tickets from your hapless product owner. Before you go and implement ElasticSearch make sure you understand how a GIN Index works. Before you use NoSQL make sure you understand that you need to modify the entire structure in memory before you flush it. Make sure you understand that this makes it hard to buffer write queues that are linearizable and get predictable inserts. Make sure you know what linearizable means. Understand these principles. They will save you time. They will save you energy. They will save you stress. You will not only be happier, but as a professional you will also be magnitudes upon magnitudes better.

Principles are understanding, and to understand is to be able to create.

git gud.

- I added in an analytics page and exposed it just to drop that 0 readers gag. Smash like and subscribe.